LSST Lecturer publishes paper on public debt and real output over 300 years in prestigious Journal of Economic Asymmetries

By Kunal Chan Mehta | Article Date: 21 May 2021

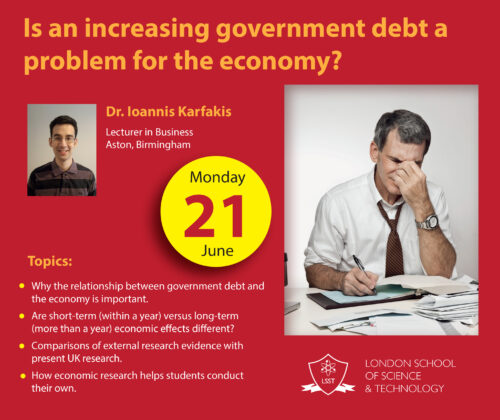

Dr Ioannis Karfakis, a Business Lecturer at LSST’s Birmingham Aston campus, has published a dynamic article about the predictive content of public debt (how much a country owes to lenders – such as individuals, businesses and other governments – outside of itself) for real output expansions and contractions over three centuries in the prestigious Journal of Economic Asymmetries.

As public debt can be an ideal way to get extra funds to invest in economic growth, the paper initially examines the historical pattern of the growth rate of real output in the UK to identify expansions and contractions.

‘This publication asks: can changes in the debt of the UK government predict patterns of the country’s economic growth?’ said Dr Karfakis. ‘This research provides an understanding of the potential economic effects in the case of a severe debt crisis by looking at historical data from similar events that took place. Owing to the large data collected, we gained a much better insight on how government policies should be designed.’

The paper also looks at the growth rate of the debt-to-GDP ratio as a leading indicator of economic growth and recession, and the transition probabilities between the two regimes. The Markov switching analysis used by Dr Karfakis shows that an increase in the growth rate of the debt-to-GDP ratio has reduced economic growth and has increased the probability that the economy will switch from economic expansion to contraction.

‘The research shows that the best way to prepare for future economic events is to look at the past – and to sincerely learn from it,’ added Dr Karfakis. ‘Regarding my own academic experiences, I want to convey to LSST students that no matter how hard and bumpy your educational journey, stay focused on the final target and keep learning until there.’

Mr Mohammed Zaidi, LSST’s Deputy CEO, added: ‘I congratulate Dr Karfakis on his publication. His work is an inspiration to our students and our staff who are passionate about academic publishing and research. LSST immensely values its expanding knowledge-community that it creates and sustains to improve professional thinking and performance across our nationwide campuses.’

Register for the event here: www.lsst.ac/list-events/

Paper reference:

Karfakis, I. (2021) “The predictive content of public debt for real output expansions and contractions over three centuries: A Markov switching analysis for the UK”, The Journal of Economic Asymmetries, 24, e00205.